SEVERAL banks in Reading have now announced they will be closing after mass closures across the country.

So far this year, Halifax, HSBC, Barclays, Lloyds and Virgin Money have announced branch closures.

Most recently Virgin Money, on Friar Street in Reading, has announced it will be closing on November 15 as plans to close 39 branches across the country.

Several banks have already been closed this year, including Natwest in Tilehurst which closed on June 28.

Earlier this year, on February 7, Natwest in Henley-on-Thames closed its doors.

Full closures of branches in Reading and West Berkshire:

- Virgin Money, Reading - set to close on November 15

- Natwest, Tilehurst - closed on Thursday 28

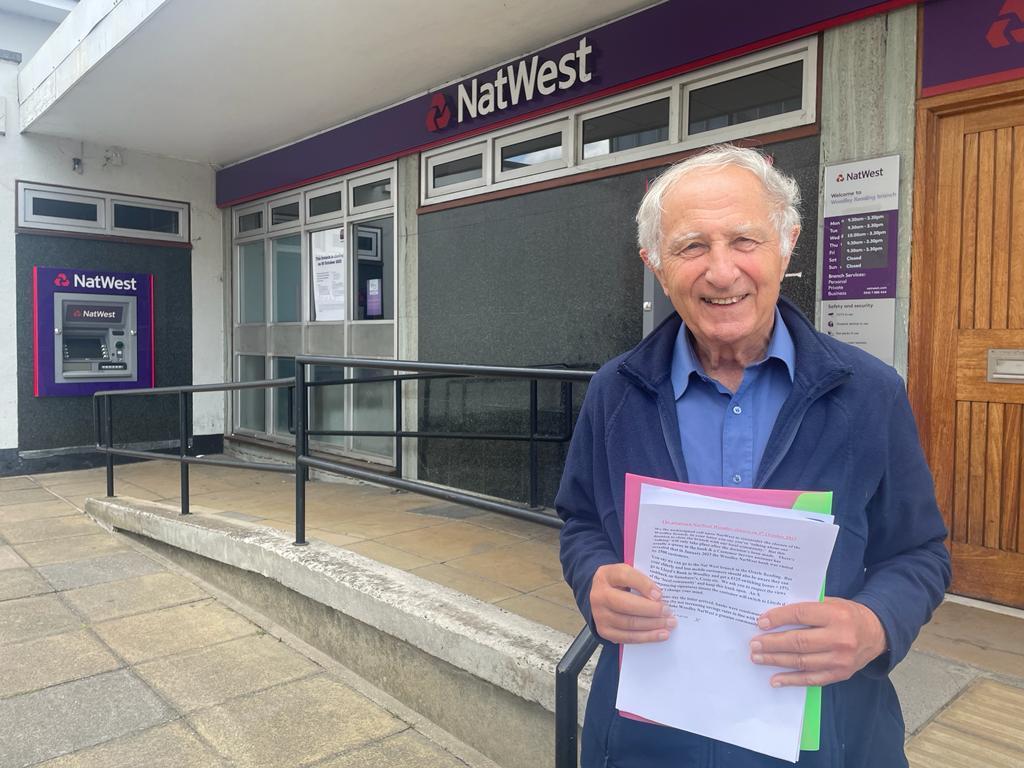

- Natwest, Woodley - set to close on October 5

- Natwest, Henley-on-Thames - closed on February 7

- HSBC, Henley-on-Thames - set to close on August 8

Banks have been announcing closures in their masses after there has been a move to online and mobile banking, meaning fewer people are using banks in person.

Age UK has previously raised concern about rising bank closures, stating that "hundreds of thousands of older people" are being left without convenient access to basic banking services.

The issue has also divided Reading residents, with many sharing concerns about vulnerable people who might not have access to online banking.

A frustrated Woodley resident, Dudley Jones, decided to rally residents to sign a petition which calls on Natwest to revoke their decision to close the Woodley branch.

READ MORE: Natwest customer sets up petition to prevent closure

Dudley said: "I’m sick of this. I moved to Natwest three years ago when Santander closed down.

“Over the past few years, they have been terrific and everyone in the bank were so helpful – especially as I am not very good with technology".

Also having their say, post office staff member Stephanie Gilliam, said staff are "fed up" of the abuse they are getting, "because the banks are telling the customers that we do the same transactions as the banks and we don’t."

Samantha Vigor said the loss of banks is "turning our villages into ghost towns."

READ MORE: Post office staff 'fed up of abuse' amid mass closures of banks

Speaking about the impact, a NatWest spokesperson said: “We understand and recognise that digital solutions aren’t right for everyone or every situation, and that when we close branches we have to make sure that no one is left behind.

“We take our responsibility seriously to support the people who face challenges in moving online, so we are investing to provide them with support and alternatives that work for them.”

If you are being impacted by bank closures, get in touch by emailing megan.oneill@newsquest.co.uk

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel