Council taxpayers in Reading are set to be hit with an extra £56-£169 a year cost, with council taxes set to rise by almost five per cent.

A council tax increase of almost five per cent is planned this year as part of Reading Borough Council’s (RBC) budget.

A Band D household - the average in the UK - would have to pay an extra £84, if the plans are approved.

READ MORE: People in West Berkshire facing council tax increase

Most Reading residents – 40 per cent are in Band C – would have to pay an extra £75 a year.

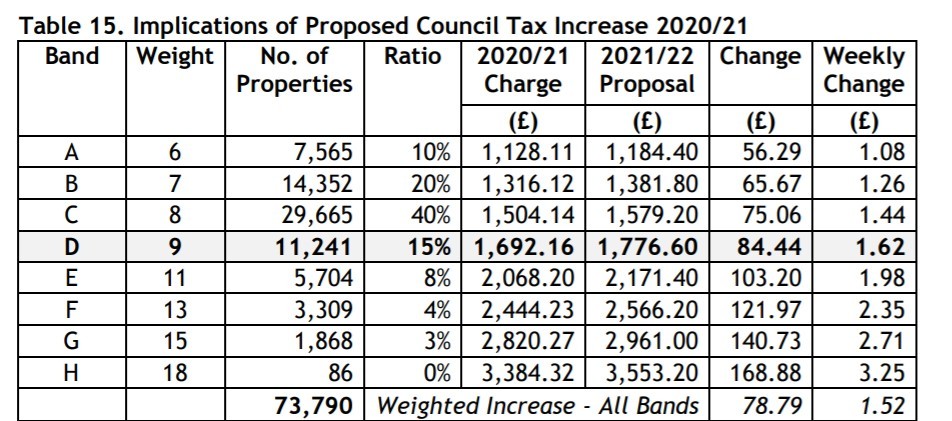

Here is a table showing how it will affect each band.

Implications of proposed council tax increase

The council will vote on the plans later this month, which include council tax increases, the budget for the year and its medium-term financial strategy for the next three years.

RBC is proposing a three per cent adult social care precept – a council tax where the money is reserved to be used for adult social care – alongside a 1.99 per cent council tax rise.

This is the most the council is able to increase council tax without calling a referendum.

The council says Covid-19 has exacerbated the funding crisis in adult social care which existed long before the pandemic.

Council leader Jason Brock said: “The crisis in adult social care funding existed long before the Covid pandemic arrived.

“Despite repeated promises, central government has failed to deliver a long-term and sustainable funding solution for adult social care and has instead continued with its ‘sticking plaster’ approach.

“The government boasts of increasing the ‘spending power’ of local authorities, but this is only by allowing them to increase the adult social care precept by up to three per cent and is in the knowledge that many local councils have little option but to take it up at this extremely challenging time, thereby placing the burden on hard-pressed residents.

“Caring for the borough’s elderly and vulnerable residents is fundamental to what the council does and has never been more important.

“Alongside NHS and other public sector staff, social care workers in Reading have been heroes of the Covid 19 response locally.

“We know those pressures will continue into the year ahead and, as unwelcome as the council tax rise may be, we need to factor those pressures into the new budget.”

The total council tax payable will also include the Fire and Police authorities’ precepts which have not yet been confirmed.

RBC is also planning to introduce new penalties for failing to disclose important information relating to your council tax and benefits eligibility.

In the council’s financial strategy, there are £28 million of savings planned over the next three years, with £15 million of that in this year’s budget.

The council is continuing plans to invest in services such as:

- £9 million road and pavement resurfacing

- More than £40 million on leisure facilities including pools in Rivermead and Palmer Park

- £1.5 million on the new food waste collection service

- £7 million on energy saving measures in buildings and renewable energy infrastructure

- £20 million on Green Park Station, and £3.2 million on the refurbishment of Reading West Station

- More than £30 million for estate regeneration and new affordable council homes, including accommodation for rough sleepers

- £43m investment in “modern and fit for purpose” sheltered housing for older people, and supported accommodation and day facilities for vulnerable adults

- £9m on Hamilton School to provide spaces for children with special educational needs, alongside £4.5m on the conversion of The Avenue offices to provide additional Special Education Needs school places.

The budget will first go to Policy committee on Monday, February 15, for endorsement, before going to the full council on February 23 for approval.

RBC ran a consultation last month on its draft budget, which had not yet included a decision on how much council tax to charge.

A total of 114 responses were received and a majority of responses supported the proposals, according to the council.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here