WEST BERKSHIRE COUNCIL (WBC) is set to abandon its investment plans in commercial property, and spend earmarked money on social housing instead.

The council has borrowed £100 million to buy shops, offices and warehouses across the country. Rent from these properties is used to fund public services in West Berkshire.

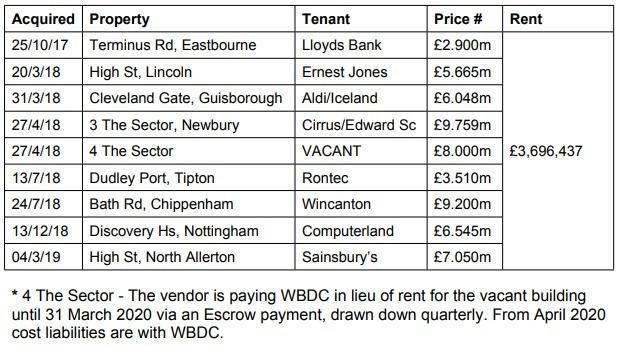

So far, £62.6 million of that money has been spent, buying nine properties.

READ MORE: Where to build huge housing developments decided ‘behind closed doors’

But, with the real estate sector currently performing badly and the government discouraging councils from borrowing to invest in commercial property, WBC is considering spending the remaining £37.4 million elsewhere.

Instead, that money could be spent on building affordable homes, solar panels, wind turbines and planting trees. That’s according to Richard Turner, the council’s property services manager.

Councillors on the overview and scrutiny management commission will consider what to do with the leftover £37.4 million at a public meeting on January 14. In a report to that meeting, Mr Turner warned rental income could be less than a quarter of what was first predicted.

READ MORE: Food waste bins could soon be introduced in West Berks

Initially, the scheme was supposed to raise £2 million in rent each year, which the council could spend on public services in West Berkshire. But now the income for next year is forecasted at only £454,763.

This is partly because one property, in Newbury, is currently vacant: 4 The Sector. The council paid £8 million to buy this office block, and will not be getting any rent income from April onwards.

The other properties include supermarkets and shops, as far away as Nottingham and Lincoln. The cheapest was bought for £2.9 million, and the most expensive was £9.76 million.

Mr Turner said: “The most recent purchase was in March 2019, with no suitable property being brought forward since then.

“This is both linked to the economic uncertainty which exists within the commercial property sector, associated with low levels of commitment from tenants to moving or expanding and taking on new lease commitments.”

Last month, one of the biggest commercial property funds in the UK was suspended. M&G has stopped investors removing money from its property portfolio fund, reportedly due to “Brexit-related political uncertainty” and difficulties in the retail sector.

In October last year, the Treasury increased the interest rate for councils to borrow, from 1.8 per cent to 2.8 per cent. This was to discourage councils from borrowing to invest in commercial property, according to the Bureau of Investigative Journalism.

Mr Turner said: “With the declaration of a climate emergency … and ongoing pressures within the housing sector for affordable housing, investment priorities may be re-aligned with the council’s emerging environmental strategy and its refreshed housing strategy.”

Both the housing and environment strategies are still being drawn up, and will have to be approved by councillors.

Since 2017, WBC has spent £502,150.29 on property consultants to advise which properties to buy, according to a recent freedom of information request.

Most of that money spent on consultants went to Montague Evans, who have received £494,650.29. Jones Lang LaSalle received £7,500.

The commercial property investment strategy was first voted through on May 9, 2017. Mr Turner said: “Traditionally, local authority property acquisition has been for the direct purpose of operational delivery of services.

“However, increasing financial pressures combined with significantly reduced resources meant that West Berkshire Council needed to consider the potential opportunities … to generate new revenue income streams through property investment.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here