The council leader has called for a ‘sustainable and realistic’ plan from the government on how to fund local authorities, after the local government finance settlement (LGFS) was announced last week (December 13).

The announcement included the news that Reading Borough Council (RBC), along with the five other Berkshire authorities, will keep 75 per cent of its business rates in 2019/20,

RBC expects to get a one-off benefit of £2.3m from the business rates retention pilot scheme.

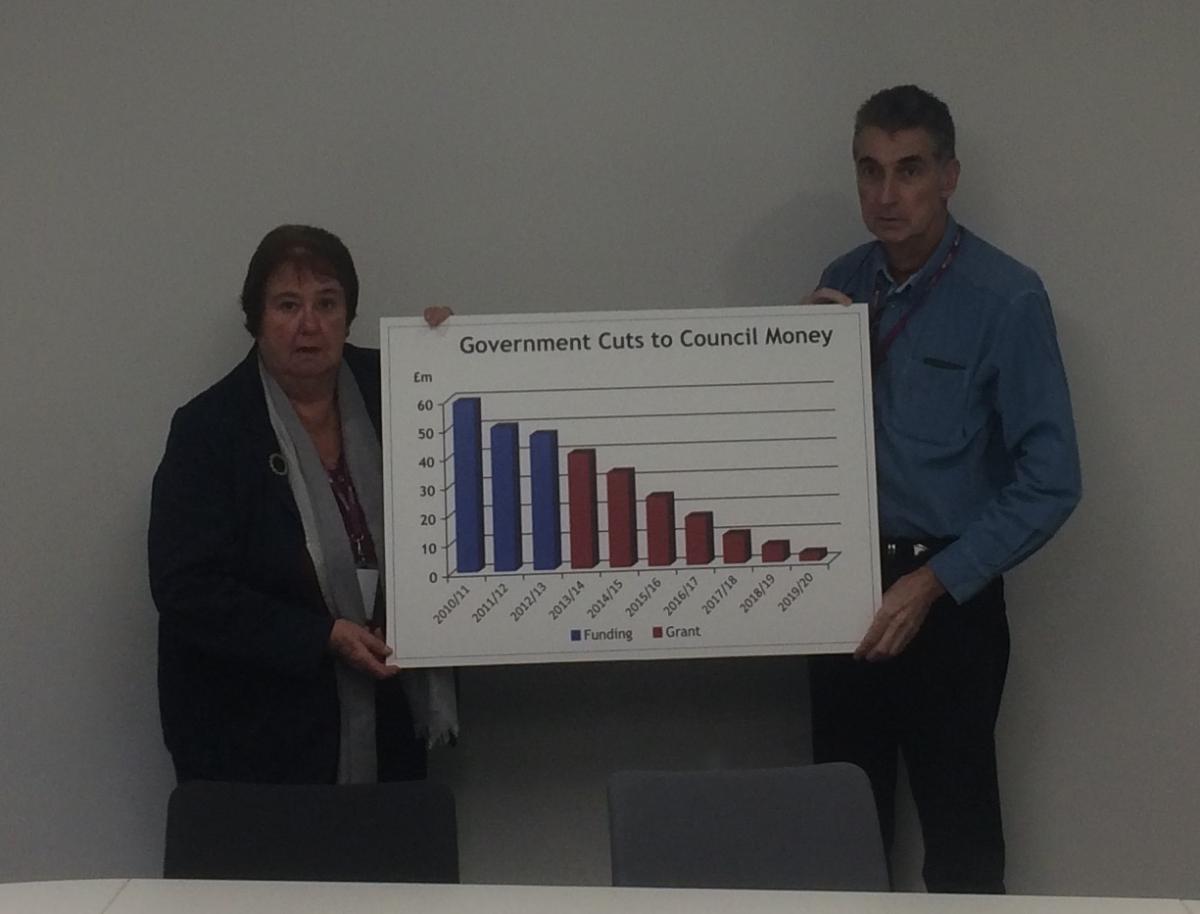

Jo Lovelock, leader of the council, said: “While the delayed settlement contains some better news for Reading, it needs to be taken in the wider context of a decade of reductions in the council’s grant from government, which has been cut by nearly £58 million between 2010 and 2020.

“I am pleased to say Reading has again been successful in its bid to be included in the national Business Rates pilot for another year.

“What is still missing however is a sustainable and realistic plan from Government on how it intends to fund local authorities going forward.”

The five other Berkshire authorities - Bracknell Forest, Wokingham Borough, West Berkshire, Slough Borough and Windsor and Maidenhead – are also part of the business rates retention pilot scheme.

As part of the scheme, the six authorities each agreed to invest 50 per cent of the retained receipts – believed to be around £11m – into the Thames Valley Local Enterprise Partnership (LEP)

Cllr Lovelock said funding the LEP is ‘particularly important at this time of uncertainty’ and will allow enable investment in infrastructure projects that will ‘boost local economies and encourage business growth’.

RBC was able to keep 100 per cent of its business rates this year, with 70 per cent going to the LEP.

The pilot is part of the government’s plans to increase business rates retention to 75 per cent across the UK from 2020.

James Brokenshire, secretary of state for housing, communities and local government also announced the option for councils to raise council tax by three per cent.

The government previously allowed local authorities to increase the tax on domestic property by 2 per cent.

Cllr Jo Lovelock, leader of RBC said: “That is a decision we will have to make whilst considering the council’s financial position and the difficult decisions that still need to be made next year.”

The settlement, presented by James Brokenshire was announced a week later than initially proposed due to parliamentary debates on Brexit.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel